eSewa is widely known as Nepal’s first and most trusted online payment service provider. Since its official launch on January 25, 2010, after a beta release in 2009, eSewa has continued to grow with an impressive vision of building a completely cashless economy. Today, people from almost every corner of Nepal have heard about this app, and many rely on it for their daily digital transactions. Because it is convenient, fast, and surprisingly reliable, thousands of new users search online for How to Create and Verify eSewa Account?, hoping to get started without any confusion.

Despite the fact that several other payment gateways exist in the market, eSewa has managed to stay ahead because of its strong goodwill and user-friendly ecosystem. With more than 10 million customers, over 220,000 agents, and more than 350,000 merchants connected to its system, it has undoubtedly become a digital powerhouse. Some people say the app occasionally feels slow during peak hours, while others appreciate its smooth experience and helpful customer support. Whatever the case, one thing is clear: eSewa has had a positive impact on Nepal’s digital financial landscape.

Before getting into its features, many new users first want guidance on How to Create and Verify eSewa Account?, especially those who are not very familiar with online banking or digital wallets. The good news is that the process is extremely simple, and anyone—with even a basic smartphone—can complete it in just a few minutes. Even if someone finds the verification process slightly confusing at first, eSewa has made the steps quite straightforward, making it easier for beginners who feel nervous about online security.

Once your account is created, eSewa provides a wide range of useful services. Users can transfer or deposit money to several banks with just a few taps on their phone. Whether you want to top-up your mobile balance, pay your electricity bills, clear your landline or ADSL bills, or recharge your postpaid number, everything is possible inside a single app. Many people appreciate this convenience because it saves time and reduces the frustration of standing in long queues. For someone who frequently pays bills or buys services online, the app truly feels like a complete digital assistant.

In addition to basic payments, eSewa also allows you to buy bus tickets, airline tickets, and even movie tickets online. This feature is extremely helpful, especially for people who live in busy cities and want to avoid unnecessary crowds. There are also options to transfer money from one bank to another, which makes the app even more powerful. Users who once hesitated to use online services now feel confident, thanks to eSewa’s secure and trustworthy system.

Because so many people are adopting digital payments, searches for How to Create and Verify eSewa Account? keeps increasing day by day. New users want a guide that is clear, simple, and helpful. Whether you are a student, a business owner, or someone who wants to avoid the hassle of cash payments, learning How to Create and Verify eSewa Account? is one of the best steps you can take toward a modern and easier lifestyle. Once you experience the comfort of digital payments, going back to cash feels unnecessarily complicated.

Why use eSewa?

- Mobile Phone Recharge and Topup

- Electricity Bill Payment

- Drinking-Water (Khanepani) Bill Payment

- Airlines / Bus Ticketing

- Movie Ticketing

- ISP Bill Payment

- School/ College Fee Payment

- Credit Card Payment

- Bank Deposit and Remittance

- Insurance/ EMI/ Finance Payment

- Events and Fairs Ticket (Cricket, Football, Concert, etc.)

There are more than 100 similar services that are made available by eSewa.

Follow these steps to Create and Verify eSewa Account:

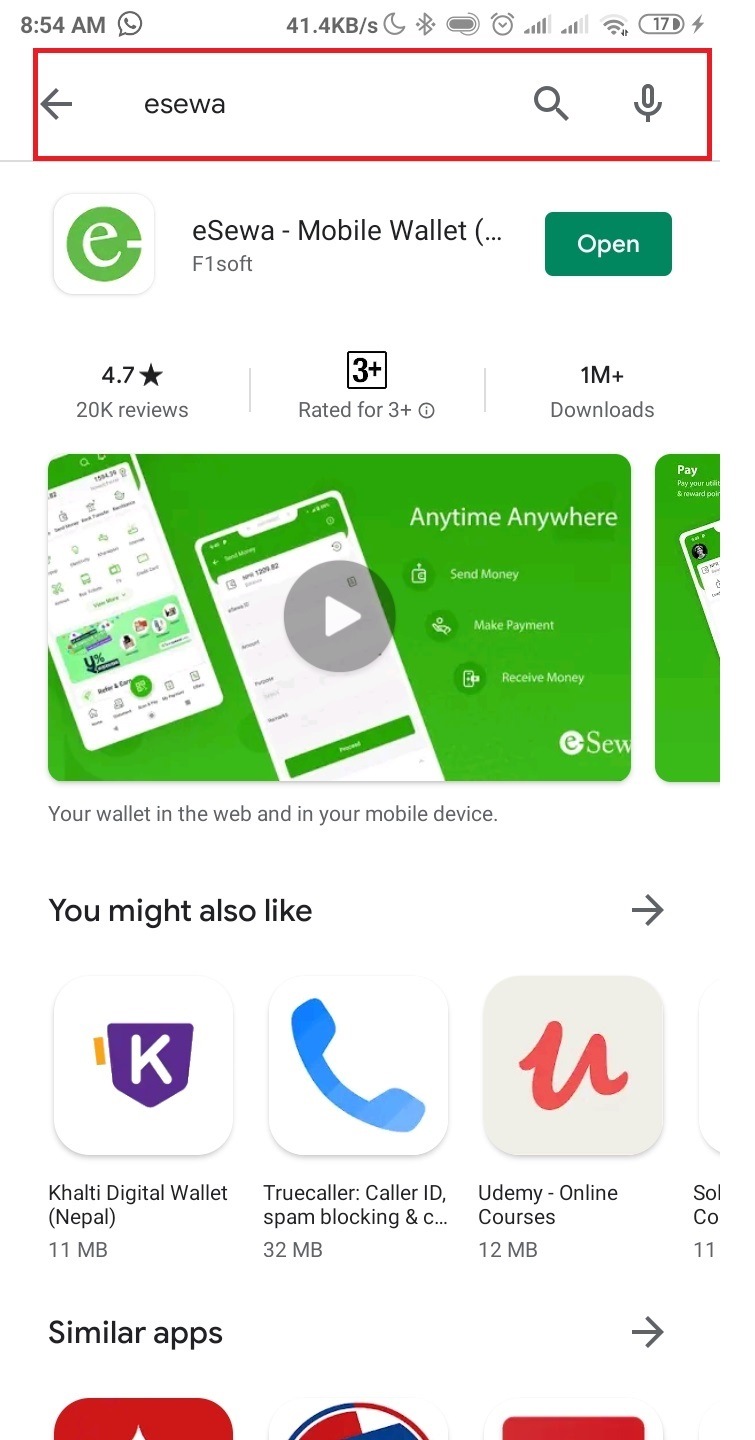

1. Open the Play Store/App Store and search ‘eSewa’ and install it.

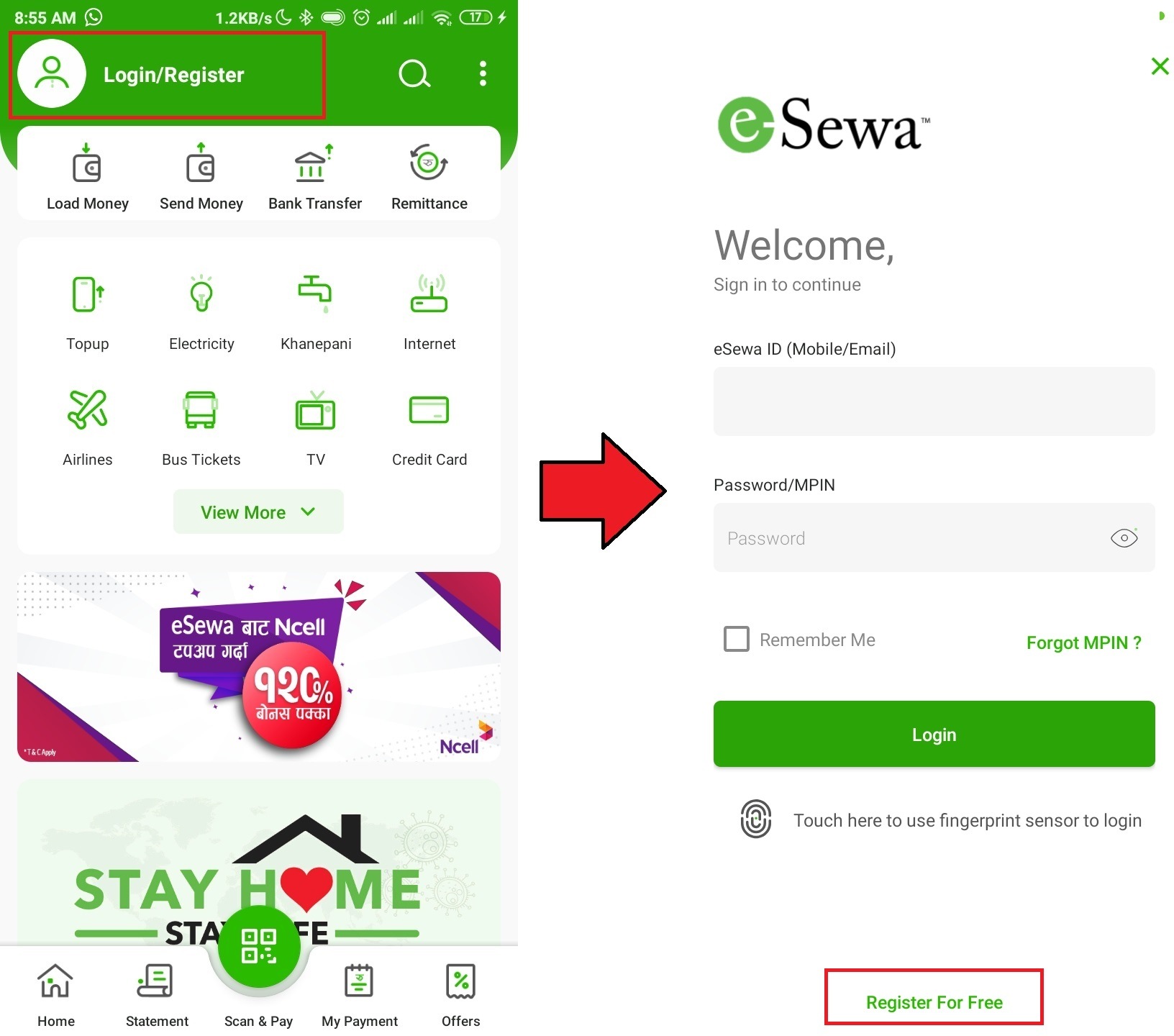

2. Open the app and tap on ‘Login/Register’ and then ‘Register for Free for’ your registration.

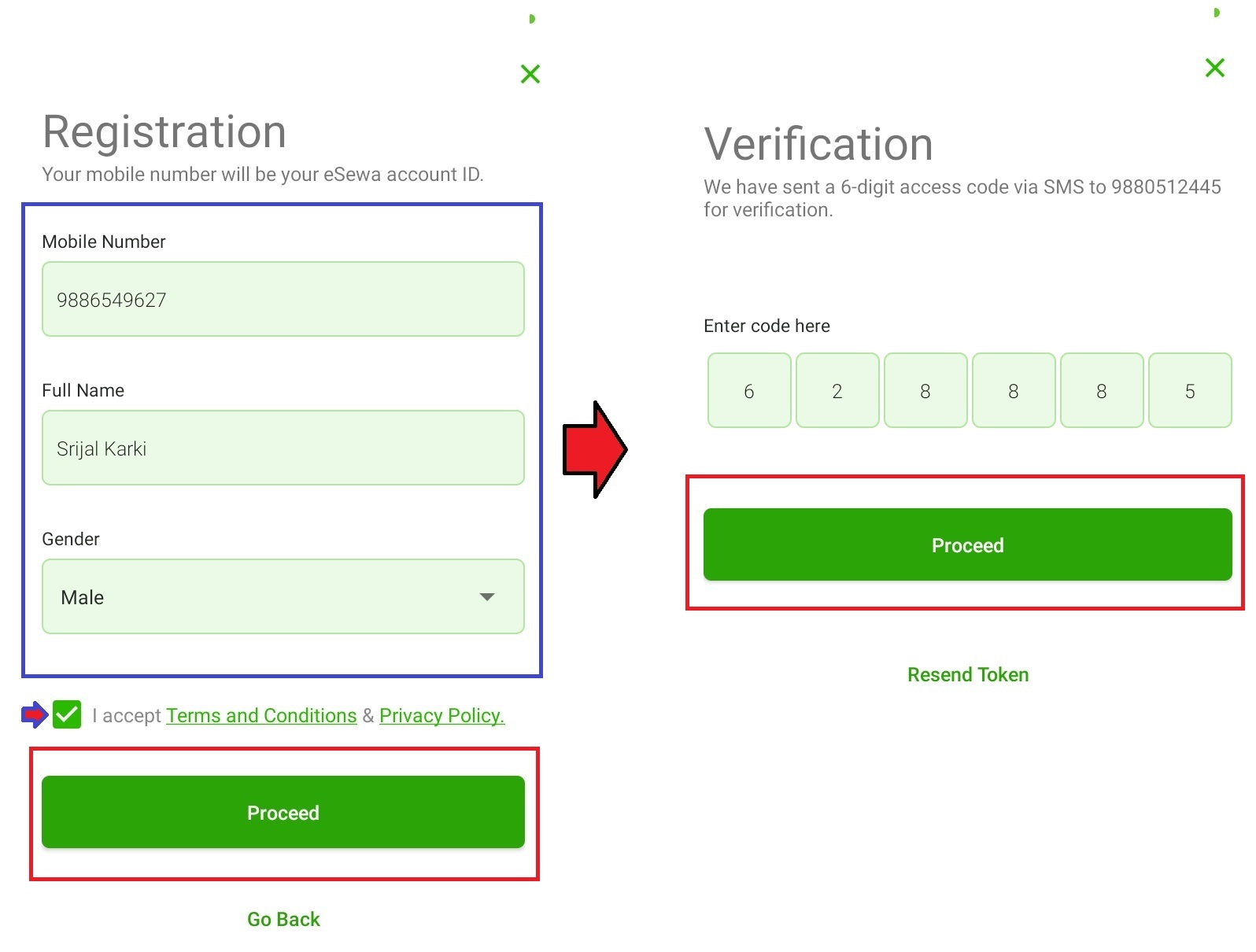

3. Fill up the registration form by adding the Mobile number, Name and Gender and tap on Proceed by verifying your Mobile number from a 6-digit verification code.

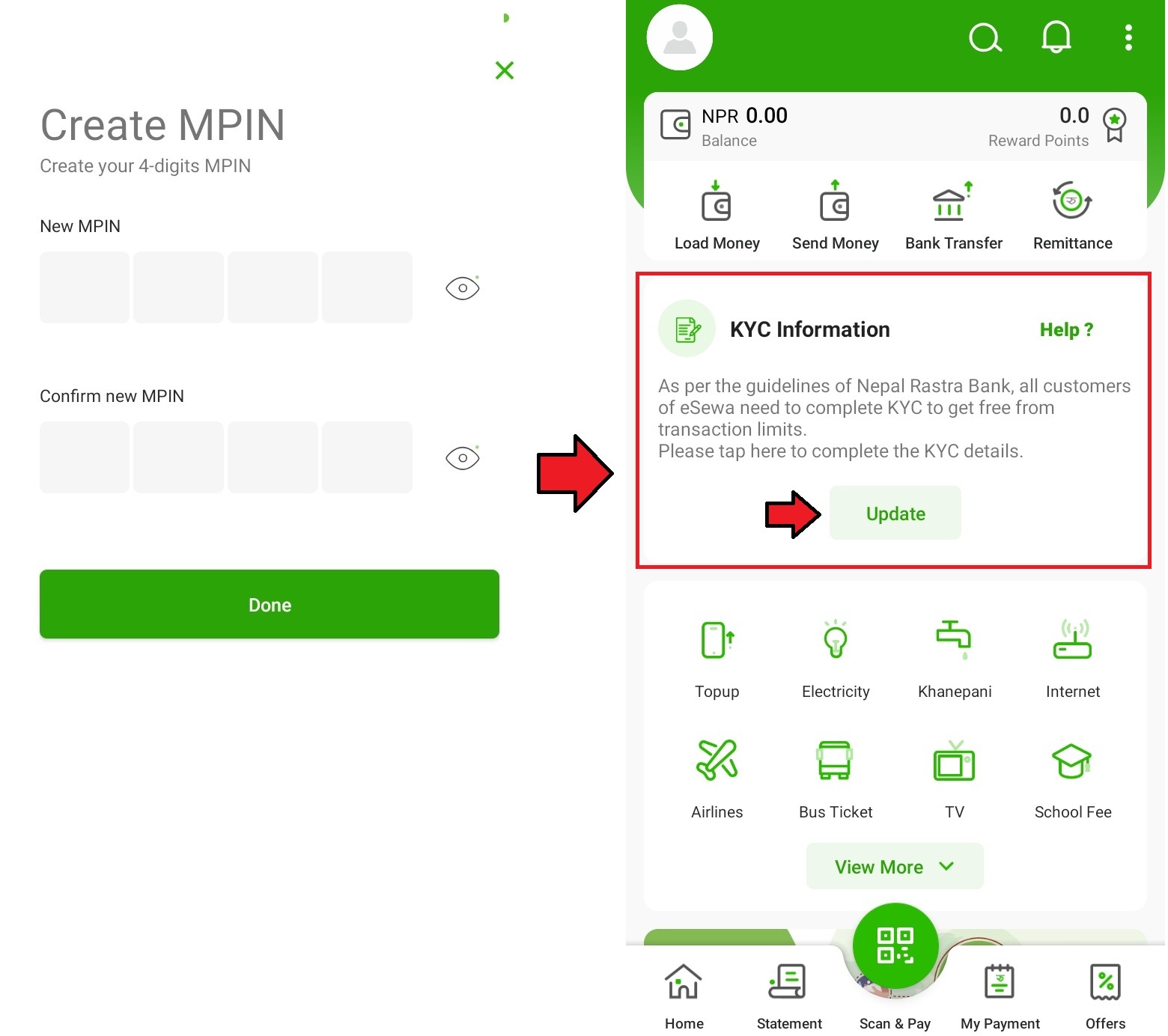

4. Set the secure 4-digit MPIN to complete your eSewa Registration. Tap Update on your Home Screen for completing the KYC form.

Note: You can also open by tapping on the profile image and then “My Information”.

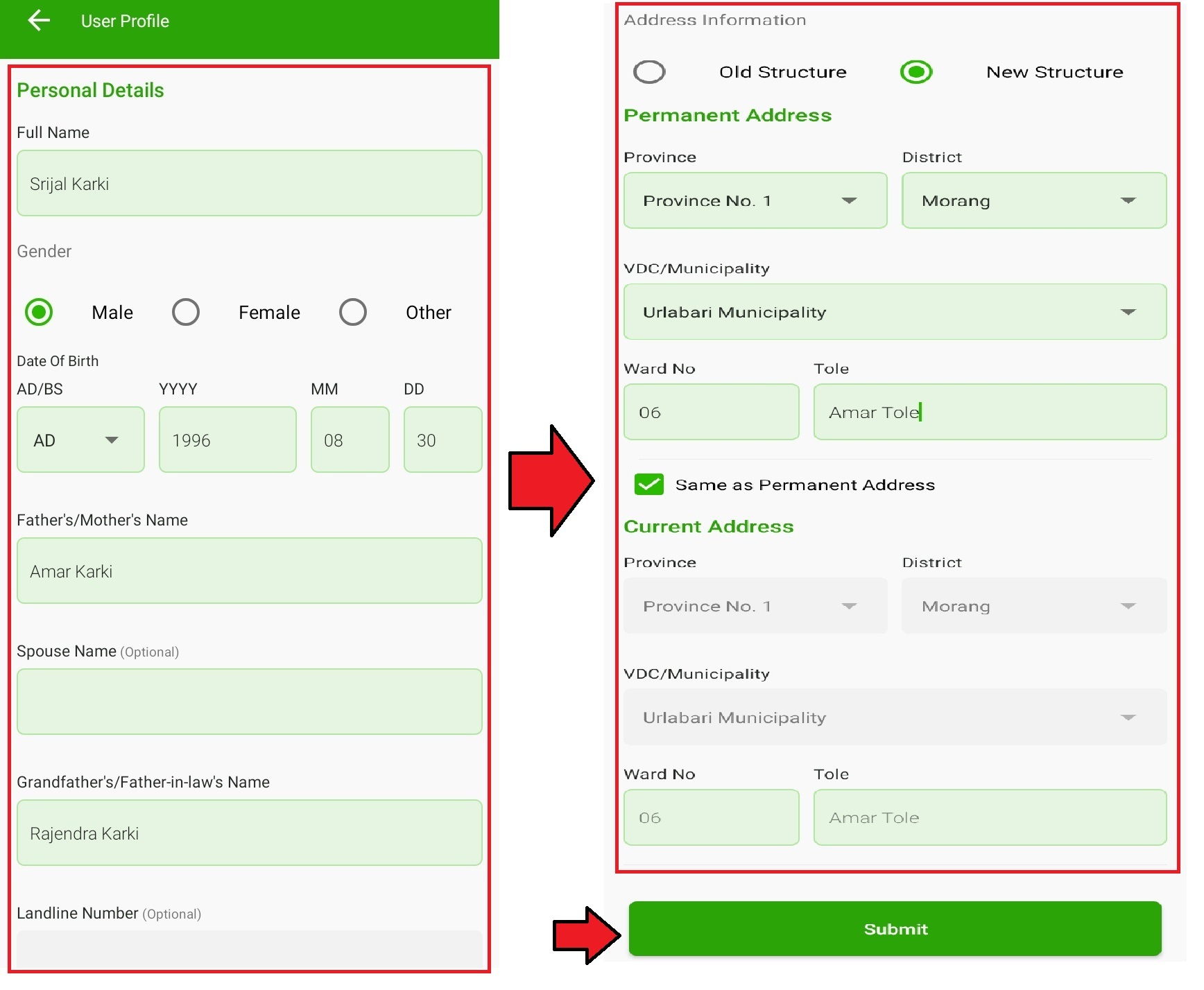

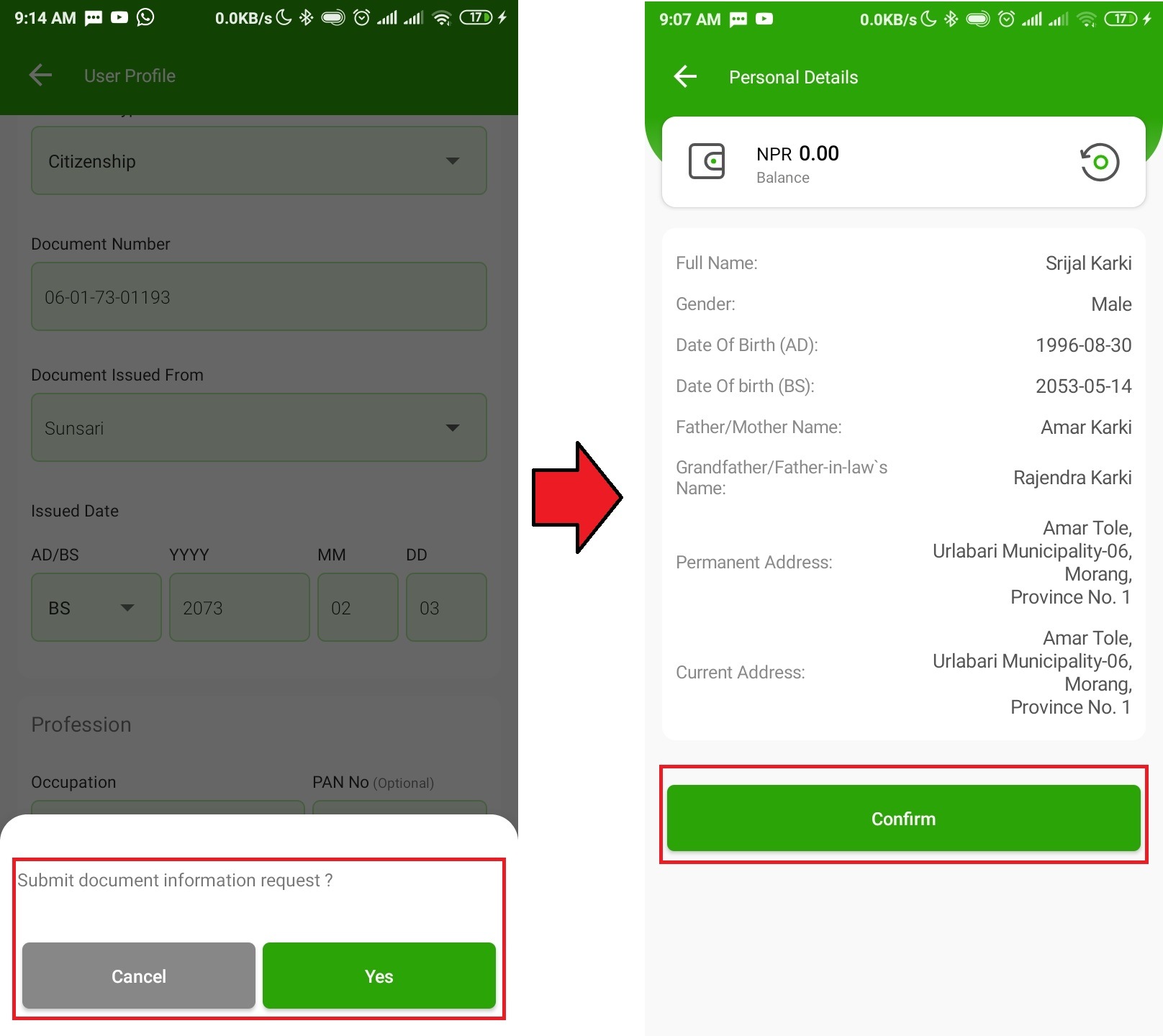

5. Now you are in KYC verification. A form will open and fill in all the details dully.

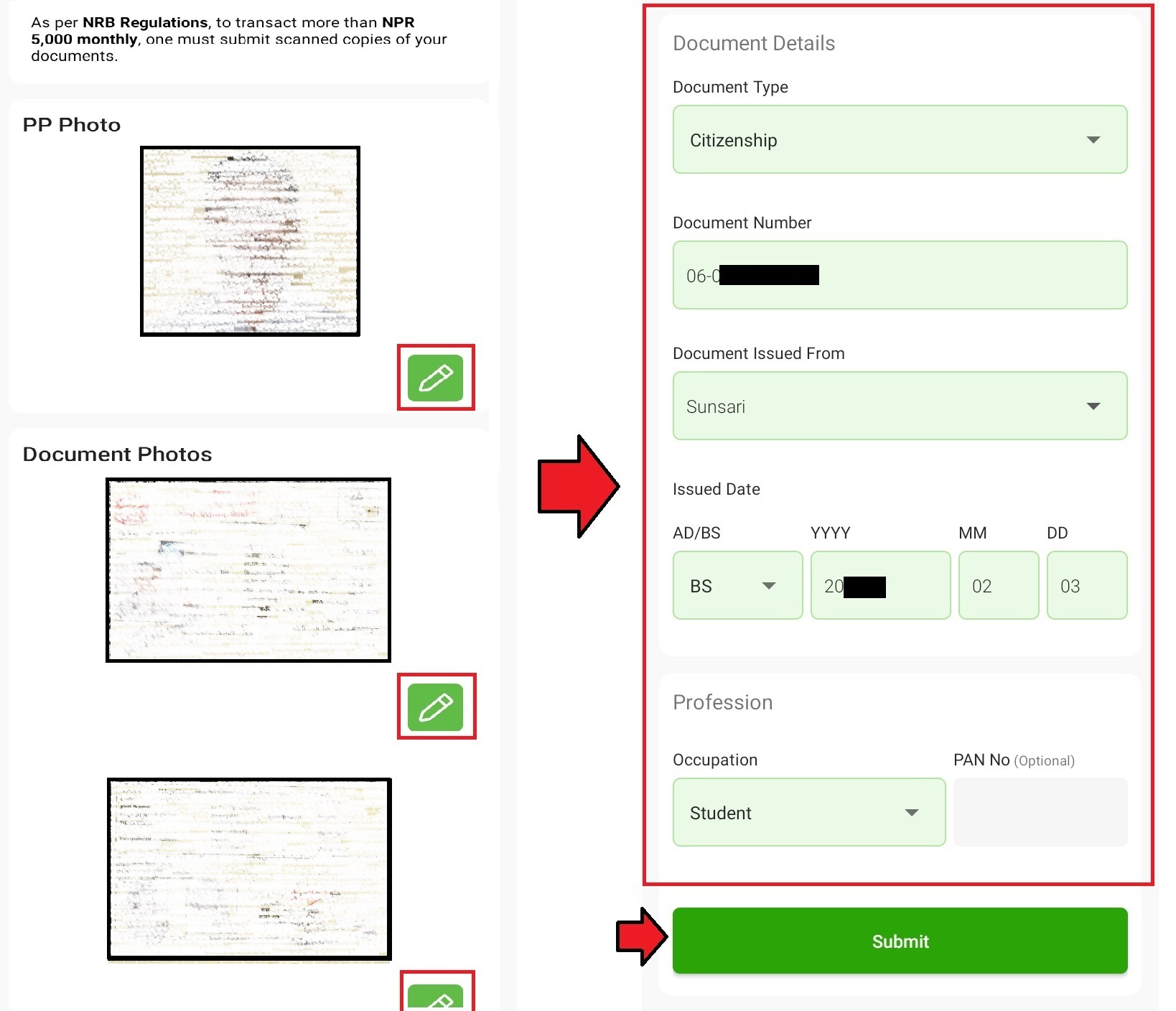

6. Attach the document asked like Photo and IDs like Citizenship or license or passport and also fill document information.

Personal details required for KYC are as follows:

- Full Name

- Father’s Name

- Grandfather’s Name

- Date of Birth

- Gender

- Contact No.

- Occupation

- Permanent Address

- Current Address

- Document information i.e. Document number, issued date, etc.

Documents required for KYC are as follows:

- Scanned photos of PP size photo

- Both sides of Citizenship/License/passport/voter ID.

7. Click on Submit and confirm your details after reviewing it to complete your KYC verification.

You will receive KYC approval within 48 hours of filling out the form.

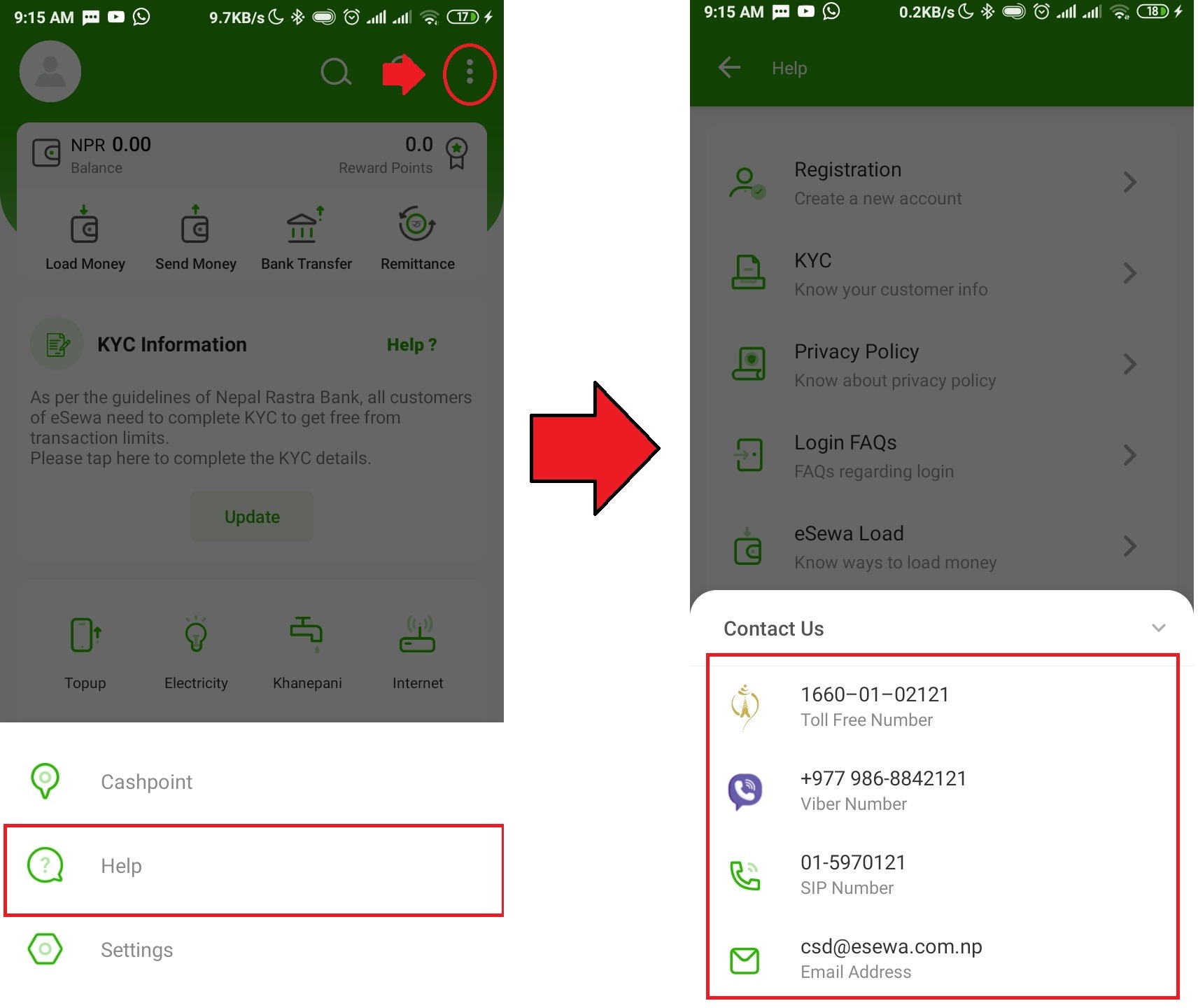

Note: If you have any issues with KYC registration Contact eSewa Customer Care. For this tap on 3 dotted lines in the top left corner and click on Help. Select the option through which you can contact.

After verifying KYC, users get various benefits like:

- Verified users will be able to transact above NRs. 5,000 per transaction.

- Verified users can transfer money from their wallets to bank accounts maintained at eSewa Member Banks at minimal charges.

- Verified users can receive the amount from Western Union directly in their eSewa account.

In this way, you can Create and Verify your eSewa Account. You can enjoy hundreds of offers by sitting at home if you have an eSewa account.

Although you have installed and verified your eSewa account, you need to load money for the transaction. Here’s how to load money in an eSewa account.

Watch video tutorials here

Frequently Asked Questions (FAQ)

1. What is eSewa?

eSewa is Nepal’s first and most popular digital wallet that lets you make online payments, transfer money, top-up your phone, pay bills, and purchase tickets easily from your mobile.

2. How to Create and Verify eSewa Account?

You can create an eSewa account by downloading the app, entering your mobile number, filling in basic details, and completing KYC with your citizenship or driving license. The verification usually takes a few hours.

3. Is eSewa safe to use?

Yes, eSewa is highly secure. It uses encryption, secure login, and identity verification to protect your money and personal information. Millions of users trust the platform every day.

4. What documents are required for verification?

To verify your eSewa account, you need a valid Nepali Citizenship, Driving License, or Passport, along with a recent passport-size photo.

5. How long does eSewa KYC verification take?

Most KYC verifications are completed within 24 hours. In many cases, it gets approved in just a few hours if all details are correct.

6. Can I use eSewa without verification?

Yes, but with limited services. For full features like bank transfer, wallet load, and higher transaction limits, you must verify your account.

7. What can I pay through eSewa?

You can pay electricity bills, water bills, mobile top-ups, ADSL, landline, internet services, school fees, insurance, airlines, bus tickets, movie tickets, and many more.

8. How do I load money into my eSewa wallet?

You can load money from your linked bank account, via mobile banking, through eSewa agents, or by using the fund transfer option from various banks.

9. What should I do if my KYC gets rejected?

If your KYC is rejected, check the reason shown in the app. Usually, it happens due to unclear photos, mismatched information, or missing documents. Correct the issues and resubmit.

10. Is eSewa better than other digital wallets?

eSewa is one of the most preferred wallets in Nepal because of its long-standing trust, wide merchant network, and easy-to-use features. However, the choice depends on your personal needs and preferences.

I hope this article was helpful to you. If you have any queries regarding this, do comment on us.